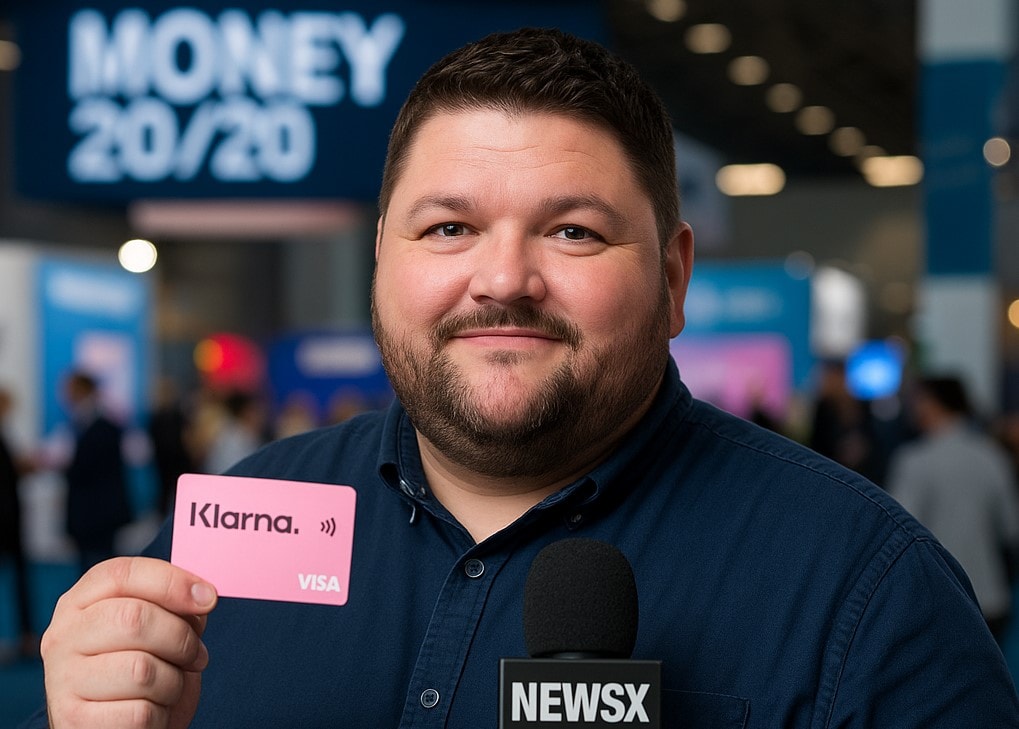

By Chris Dickinson in Amsterdam for newsX

Here in Amsterdam at the Money20/20 Europe conference, fintech launches are coming thick and fast, but Klarna’s new debit card is the one that’s got everyone leaning in.

Backed by Visa and built around Klarna’s trademark “Pay Later” features, the new Klarna Card is being billed as a modern, flexible answer to the traditional credit card. Klarna’s Chief Marketing Officer, David Sandström, even went so far as to call it “a perfect mix between debit and credit.”

That sounds great. But you might ask yourself: if it walks like credit and talks like credit, is it really a debit card?

As a reporter here covering this three-day money markets bash for newsX, I’ve seen the buzz first-hand. Klarna’s booth has been swamped. Five million people are already on the waitlist in the U.S. pilot alone. The card lets you spend from your own funds like a debit card, or split payments over time using Klarna’s Pay in 4 or Pay Later features, all from one bit of plastic accepted almost anywhere.

The card is powered by Visa’s new “Flexible Credential” system, which switches between debit and credit-like functions depending on how you want to pay. Klarna adds its usual slick app experience, complete with budgeting tools, FDIC-insured balances, and a heavy emphasis on responsible spending.

But as several delegates here pointed out, not all that glitters in fintech is gold.

There’s no interest in the traditional sense, sure. But for younger users or those already juggling costs, the concern is that Klarna’s seamless experience could blur the line between affordability and access. One tap at the checkout and you’re borrowing, without the psychological pause that usually comes with applying for credit.

Even Klarna seems to acknowledge that tension. Sandström openly pitched the card as a way to escape the traps of old-school revolving credit. And to his credit, he made a strong case. The Klarna Card, he said, appeals to “users who fear the traditional credit card.”

The question, though, is whether it should.

We’ve seen this before in fintech, well-designed products, wrapped in user-friendly language, that end up enabling the very behaviour they claimed to avoid. And with Buy Now Pay Later still largely unregulated in many markets, you have to wonder: how long before someone ends up in trouble?

Visa, for its part, sees it as an innovation that expands choice. The infrastructure is there to allow users to spend how and when they want, and Klarna’s added layer brings in all the flashy extras. But what it doesn’t bring is a formal credit line or clear red flags to slow things down.

So while Klarna positions this as the next evolution in spending, critics here in Amsterdam aren’t entirely convinced. They point to the mental sleight of hand that happens when a debit card doubles as a delayed-payment tool.

Is this financial freedom? Or is it just credit with better branding?

Klarna says it’s responsible. Visa says it’s empowering. Regulators may soon say something else.

Either way, one thing’s clear at Money20/20: fintech’s future isn’t just about speed, it’s about the stories we tell ourselves when we spend.